Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Mr Fluffy Buyback Scheme

Loose Fill Asbestos Insulation Eradication Scheme

The ACT Government has implemented a buyback scheme to all eligible home owners.

The ACT Government will offer to purchase all affected houses in order to enable the demolition of houses and remediation of the sites. The Government has commenced this process by sending eligible homeowners an offer to accept the surrender of their crown lease.

The value of the affected properties will be determined through a valuation process established under the scheme. The Territory will pay for the costs associated with obtaining two valuations of the property by valuers appointed by the Australian Property Institute ACT Division (API). The value of the property will be assessed at market value as at 28 October 2014 and as though the house does not contain loose fill asbestos. The surrender sum offered by the Territory will be the average of the two valuations.

The scheme provides for a third valuation (known as the Presidential Determination) in specific circumstances. If requested by the homeowner, the third valuation will be at the expense of the homeowner. The decision of the third valuer will be final.

Following the valuation, eligible homeowners who choose to participate in the scheme will then enter into a deed of surrender (in regard to the Crown Lease) and, where applicable, statutory declarations. Eligible homeowners will waive any right to pursue legal action against the Territory and the Commonwealth in relation to financial loss with respect to the property but will retain all their rights in respect of personal injury claims (if any).

Participants in the scheme will require independent legal advice as part of the documentation required to complete the application process.

Eligible homeowners will receive $1,000.00 (inc GST) to go towards the legal costs associated with the surrender of their lease. This will be paid on the settlement of the matter. In addition, eligible homeowners will receive a waiver of the stamp duty (to the value of the affected property) on a residential property purchased in the ACT. This may be applied to a new property being purchased or the subsequent re-purchase of the block.

Following remediation of the site, the Territory will offer the eligible homeowner a first right of refusal to repurchase the site. The repurchase price will be the market value determined independently at the time the block is offered for sale and on the basis of the best and highest use value of the block. The Government has indicated its desire to recoup some of the costs of the buyback program through this process. There may be some issues with this for particular homeowners whose blocks are suitable for subdivision.

Important Dates

- In order to participate in the buyback scheme, eligible homeowners must lodge an application with the Asbestos Response Taskforce by 30 June 2015. Applications received after 30 June 2015 will not be accepted.

- With limited exceptions, the buyback scheme will not be available to people who purchase an affected property after 28 October 2014. This means that a person who exchanges contracts on an affected block after 28 October 2014 is not eligible to apply for financial assistance under the buyback scheme and will be responsible for all costs associated with the maintenance and/or remediation of the property.

- Owners of affected properties that were purchased (contracts exchanged) within the period 18 February 2014 – 28 October 2014 who participate in the scheme will be paid the amount they paid for the affected block. The buyback scheme valuation process will not be used in these cases.

The Government has indicated that participation in the buyback scheme is voluntary. However, residents who elect to remain in their properties will be subject to increased restrictions in terms of a requirement for an asbestos management plan and other physical interventions. It is noted that such interventions are likely to have a significant impact on the amenity of the home. In some cases it will prevent the use of heating and cooling services within the home. It is anticipated that such conditions (as yet not fully determined) will be made mandatory in 2015 under the Dangerous Substances Act 2004. Any costs associated with remedial works under these circumstances will be outside of the buyback program and so will be at the cost of the home owner.

In the longer term, the ACT Government has not ruled out implementing a compulsory acquisition of affected properties.

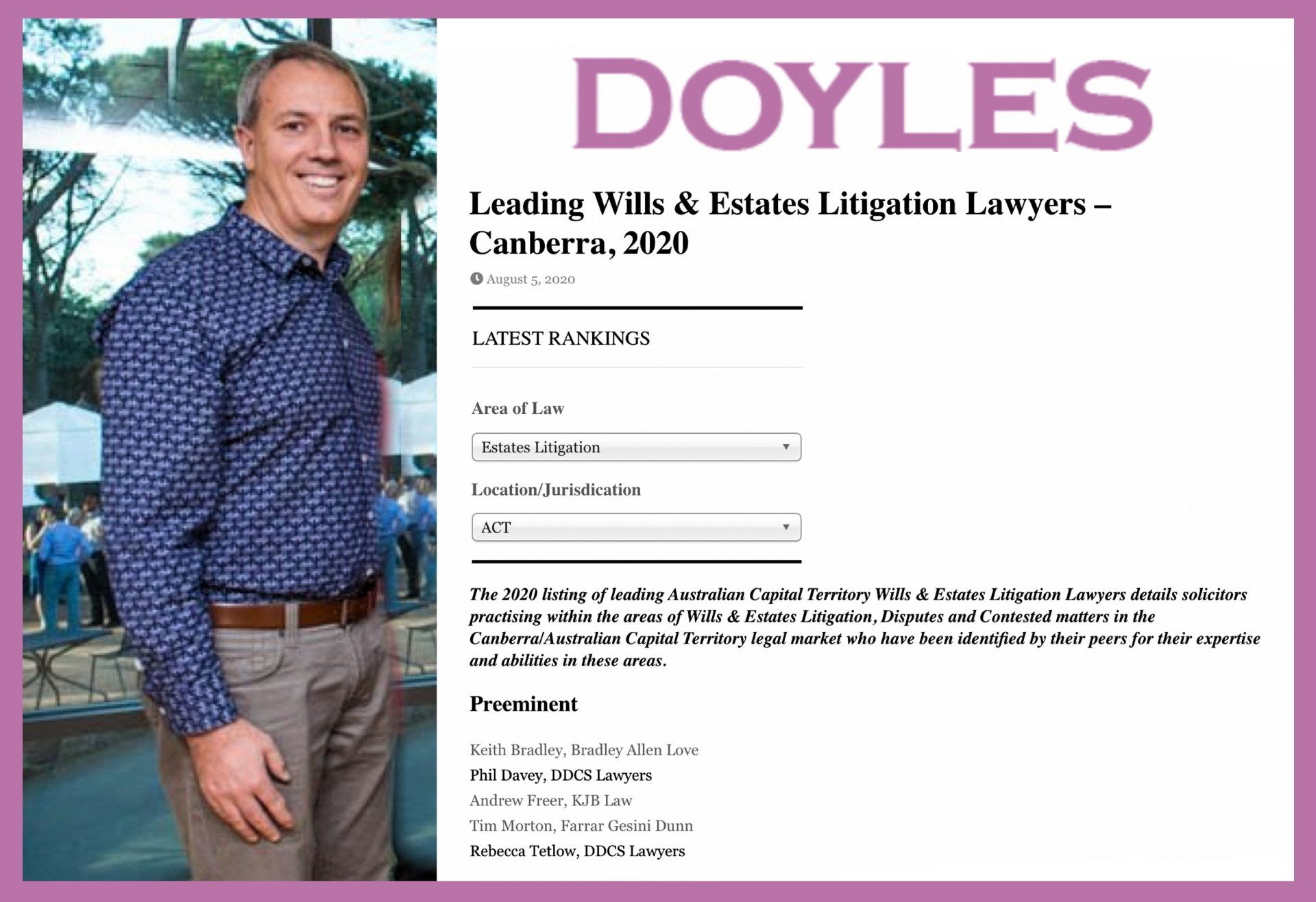

KJB will be assisting clients with advice in relation to the buyback scheme and the proposed surrender documents, when they issue. If you have a Mr Fluffy home and would like to discuss your options in relation to the buyback scheme, please contact to organise an appointment.

News

Ground floor

10 Corinna Street

Woden

ACT, Australia 2606